It costs a dime to give a dollar to Girls Inc with EITC.

Pennsylvania businesses and individuals contributing to qualified educational improvement organizations may be eligible to receive tax credits. Girls Inc. of Greater Philadelphia & Southern New Jersey is a qualified Educational Improvement Tax Credit (EITC) organization.

Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made. Tax credits equal 75 percent of the contribution up to a maximum of $750,000 per taxable year. This percent may be increased to 90 percent of the contribution, if the business agrees to provide the same amount for two consecutive tax years. You can learn more about enrolling your business here.

Click here to learn more about enrolling in EITC for individuals.

The following are Girls Inc. of Greater Philadelphia & Southern New Jersey’s EITC-qualified programs:

Girls Inc.’s Economic Literacy is designed to provide economic education to school aged girls. This comprehensive program provides participants with information on financial independence and enhances their understanding of community involvement, business and government finance, and economic systems.

Girls Inc. Operation Smart develops girls’ enthusiasm and skills in science, technology, engineering, and mathematics (STEM). Through hands-on activities, girls explore, ask questions, persist, and solve problems. By interacting with men and women pursuing STEM careers, girls come to view these careers as exciting and realistic ions for themselves.

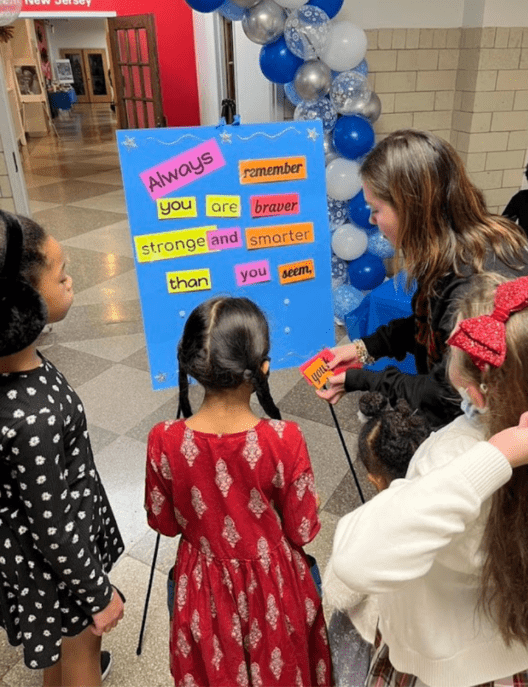

Girls Inc. Early Grade Literacy addresses the literacy-based needs of girls in grades K-3 by using a model that involves working closely with schools to align programs with school-day learning. This initiative inspires girls to use reading as a tool to discover new and exciting worlds and to learn new information about topics that interest them.